ATTENTION: medical aesthetic practice owners

How One Client Increased Revenue 164% and Operating Profit 17% in Just One Month

Find the same hidden Tax deductions, cash flow optimization, and profit opportunities in your business that you didn't even know existed — all found using our proven 90-day system.

Stop being the last person paid in your own business.

You Opened A Medspa To Make Other Women Feel Their Best But You're Constantly Stressed

You opened your practice to transform lives and build something meaningful. But instead you are...

Watching money flow in and out without really knowing where it goes

Paying everyone else first—team, vendors, loans—while your own paycheck waits

Feeling like a fraud when your CPA starts talking numbers

Making financial decisions based on gut feelings and crossed fingers

Wondering if you're actually profitable or just busy

Have you ever thought to yourself...?

"I'm making good money, but I can't figure out how to pay myself consistently."

"I avoid looking at my numbers because they stress me out and I don't know what they mean anyway."

"Every month feels like a financial rollercoaster—I never know if we're actually profitable.

"I feel like I should know this stuff, but nobody taught me how to run the business side of my business."

If you're nodding along, you're not alone.

And you're definitely not behind.

And most importantly it's not your fault.

Here's the thing most people don't tell you...

The problem is not that you're bad with money.

The problem is that you're trying to make CEO-level financial decisions without CEO-level financial clarity.

You need the same systems, dashboards, and strategic planning that 6 and 7-figure businesses use—but you don't need to hire a full-time CFO to get them.

you just need the right roadmap

I'm Jaci North,

CPA and Founder of The Peak CFO.

I've helped over 50 female business owners - especially in aesthetics and service-based industries - transform their financial chaos into strategic clarity and increased profit margins.

This is what happens when brilliant entrepreneurs finally get the financial foundation they deserve:

TRINA PAID HERSELF...

For the first time after 3.5 months of working together!

KIM INCREASED...

Revenue by 164% and operating profit 17% in one month!

AVA DISCOVERED...

$48,000 in missed tax deductions!

Can you relate to

any of the following?

You feel embarrassed to admit you don’t understand your financial statements, even though you’re the owner. You feel dumb when your Medspa owner friends start talking "shop". Like what the peak?

You’re stressed out trying to decide if you can afford that new medical device, or worse, you’ve already purchased it and now have no idea how to manage the financial impact.

You lose sleep worrying that you might be missing something important—whether it’s an expense you didn’t account for or a profit opportunity you’re overlooking.

You’re tired of winging it, hoping everything works out but knowing deep down there’s no real financial plan in place.

It's time to change that and

get you feeling...

Confident in reading and understanding your financial statements, so you always know exactly where your business stands.

Empowered to make smart decisions about big investments, like medical devices, because you know exactly what you can afford and how to manage it.

Relaxed at night, knowing your finances are under control and you’re not leaving any money on the table.

Focused on growth, with a clear financial plan, so you can finally stop guessing and start scaling with confidence.

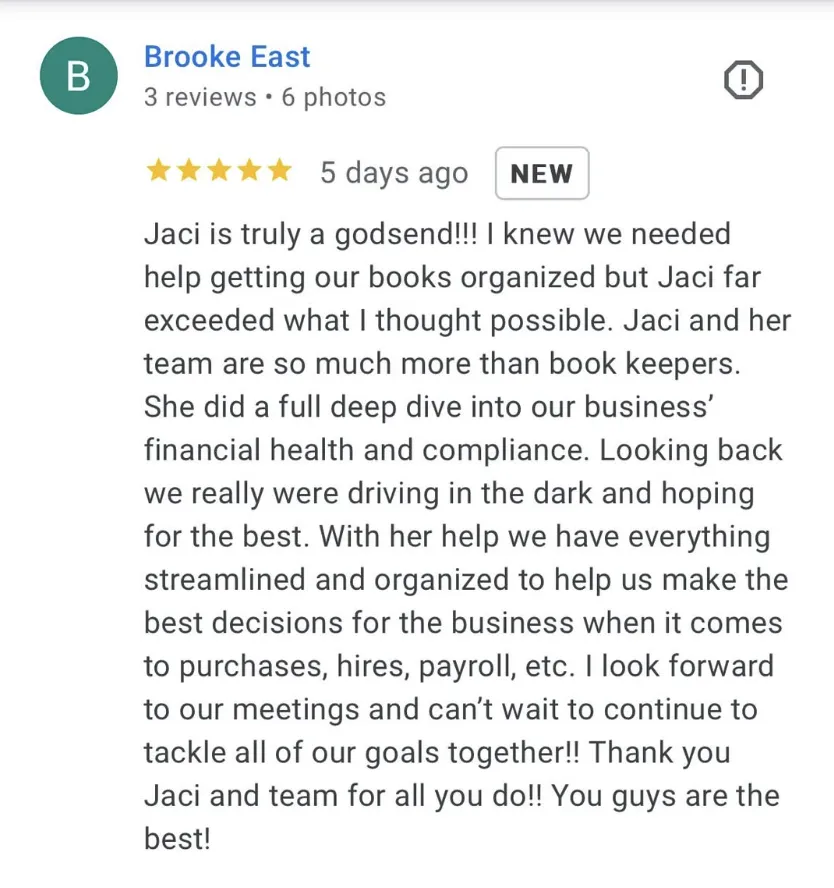

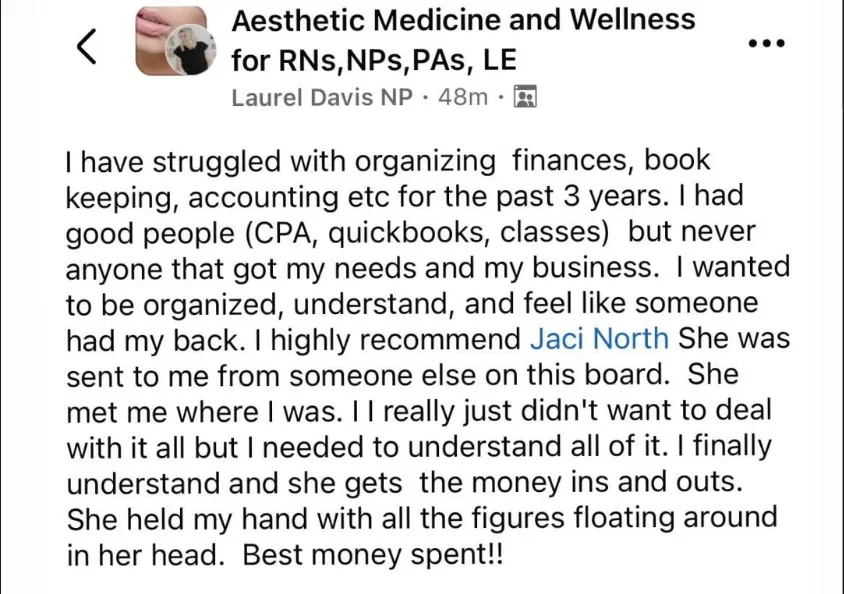

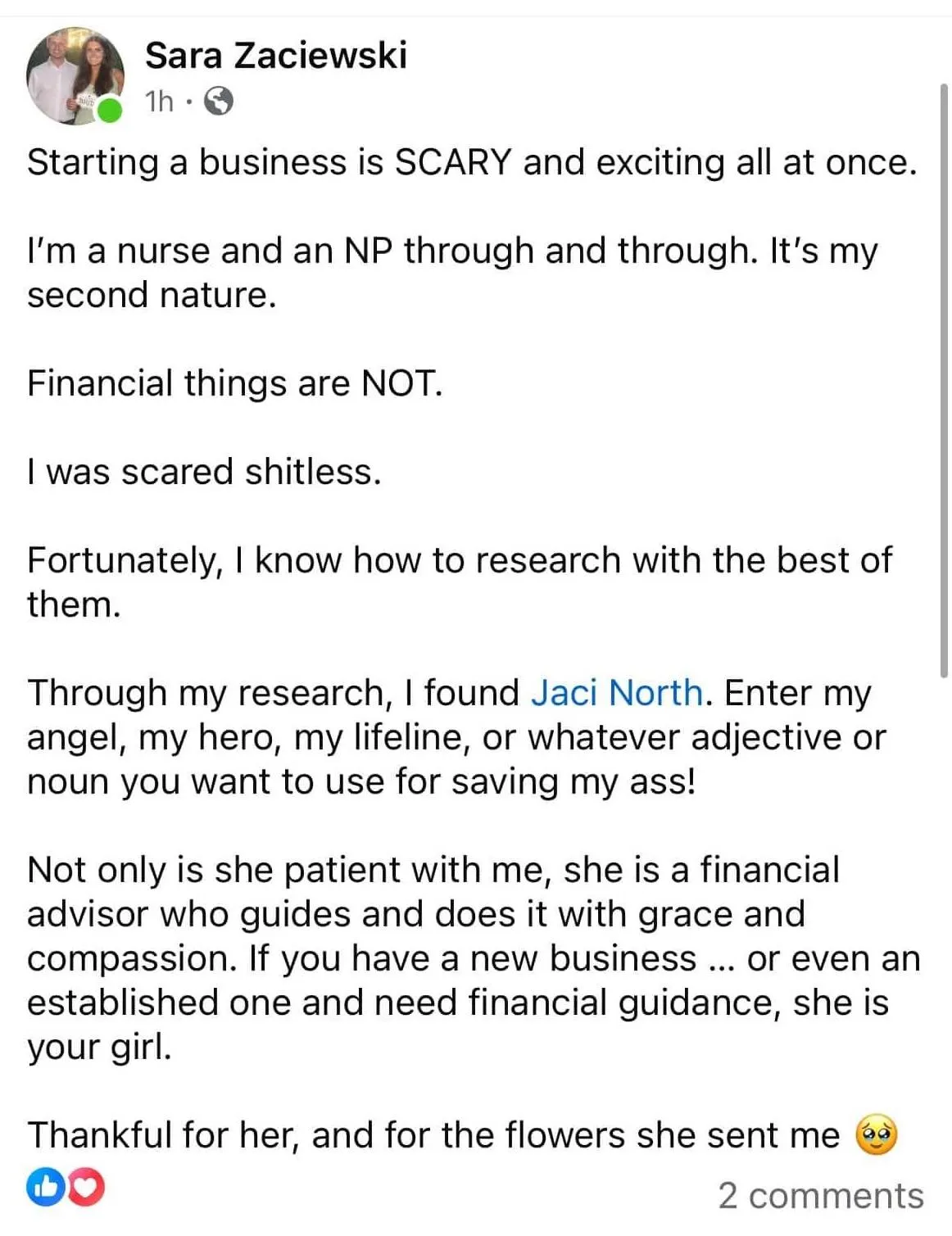

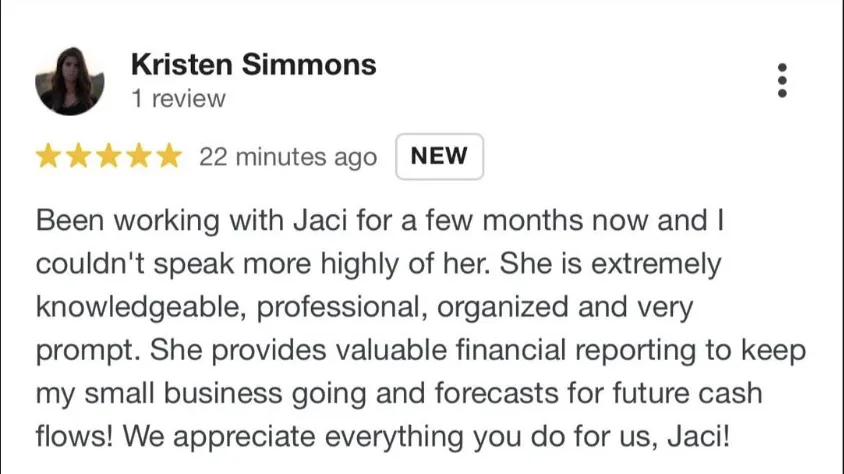

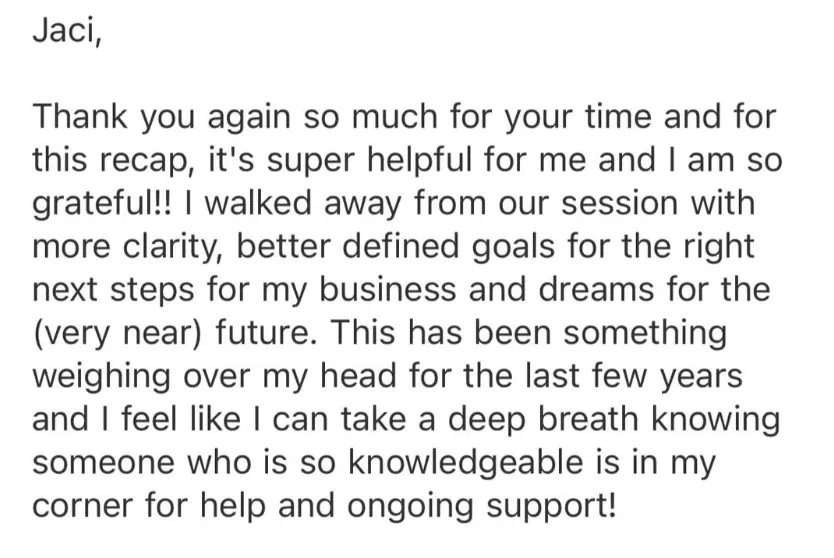

CLIENT LOVE

Proof this works

THE BEST IS YET TO COME

A look at what's ahead

STEP 1:

Let's Chat

We’ll jump on the phone and dive into all the details of your medspa. This is where we make sure we’re the right fit for each other and discuss what’s keeping you up at night when it comes to your finances.

STEP 2:

Full Financial Analysis

We’ll jump on the phone and dive into all the details of your medspa. This is where we make sure we’re the right fit for each other and discuss what’s keeping you up at night when it comes to your finances.

STEP 3:

Create Game Plan

During the first month, we’ll meet weekly to create a customized game plan for your medspa. We’ll set specific goals, tackle challenges, and map out actionable steps to get your finances on track.

STEP 4:

Implementation

Once we’ve laid the groundwork, we’ll move into implementation mode. I’ll be there for regular check-ins and ongoing problem-solving to ensure you’re on track to reach your financial goals and keep growing.

HOW DOES IT WORK?

Our Simple 3 Step Process

01

DISCUSS YOUR GOALS

To ensure we're a good fit and both aligned, we’ll start with a complimentary consultation to discuss your needs, challenges, and goals.

02

CREATE YOUR STRATEGY

Once we’ve identified your needs, our team will craft a custom strategy designed specifically for your Medspa. We’ll dive into your numbers and create a clear roadmap.

03

EXECUTE YOUR PLAN

After we’ve got your plan in place, we’ll get to work! Our team will be with you every step of the way, providing ongoing support, clarity, and solutions

ARE YOU A GOOD FIT?

Who We Work With

This is for you if you are....

Generating over $500K in yearly revenue at your med spa

You’re ready to grow your Medspa and want expert financial guidance to help you reach new levels of success.

You need someone to dive deep into your numbers and offer strategic insights, beyond just basic bookkeeping or tax filing.

You’re looking for ongoing support to help make data-driven decisions, increase profitability, and keep your business thriving.

This is not for you if...

Generating under $500K in yearly revenue at your med spa

You’re content with your current growth and don’t feel the need for advanced financial strategies or improvement.

You’re only looking for someone to file your taxes or handle simple accounting tasks, without any ongoing strategic input.

You prefer to handle your finances on your own and don’t feel the need for expert advice or partnership in managing your business’s financial health.

Apply Today!

Ready to gain financial clarity and confidence? Book a free consultation to discuss how we can support your medspa's growth! We’re excited to connect with you and help you prepare for a successful year ahead!

Real Practice Owners. Real Results.

HAVE QUESTIONS?

I've Got The Answers

Will You Do My Taxes?

While our focus is on financial strategy, clarity, and ongoing CFO support, we don’t handle individual tax filings. However, we can absolutely work with your tax professional to ensure everything is aligned and optimized for your business. Our goal is to give you the big-picture financial insight you need to make tax season smoother and more strategic.

Do you only work with Medspas?

While we specialize in helping medspa owners, our CFO services are valuable for any service-based business looking for financial clarity, strategy, and growth. If you own a business in the wellness, aesthetics, or healthcare industries, our approach could be a great fit for you!

Can I bring my own bookkeeper?

Yes, you’re welcome to bring your own bookkeeper! However, their work needs to be completed by the 10th of each month, and we’ll need to review everything for accuracy before relying on the reports. It’s crucial that the financials are accurate and up-to-date to ensure our CFO strategy is based on reliable data. If you don’t have a bookkeeper or need additional support, we can help with that too!

How long before I see results?

Every client is unique, but most of our clients begin to see increased clarity and control over their finances within the first few weeks of working together. We focus on making an impact quickly by tackling the biggest pain points first, and over time, you’ll see improved profitability and business growth.

Ready to make confident money moves?

LEGAL

Terms of Use

Terms & Conditions

Privacy Policy

Ready to make confident money moves?

Subscribe for relatable, no-fluff financial tips, behind-the-scenes client wins, and empowering advice to help you take control of your business finances—without the overwhelm.

Let’s build from a place of power, not panic.